Do you know what a GAP is in Forex? The foreign exchange market has a range of fluctuations in its transactions, which can be predicted through chart analysis and other market analysis tools. However, this fluctuation can cause sudden “jumps” in the price of a currency, without giving opportunity for transactions between one price and another. This is known as gap in Forex.

Therefore, we can define a price gap as a breakout in the continuity in the price line with respect to time. It occurs when the price experiences an upward or downward movement without any transaction between the previous price and the current price.

What is a Gap in Forex?

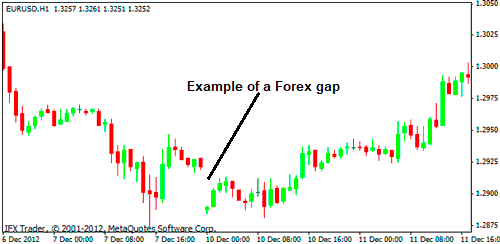

In Forex, the trend in the price of currencies is represented by price charts, so that, when a trader ends its trades, the price of the currency in question changes and a closing price occurs, to immediately express an opening price with new market transactions, either up or down. A Forex gap occurs when this price sequence presents an interruption or gap, making a drastic change between the previous price and the current price, without having made buy/sell trades in that time interval.

Gaps occur for various reasons, from market buying and selling pressures to important economic data publications that cause a temporary lack of liquidity, and transactions cannot be completed within a certain price range. In this way, the price jumps from one value to another without going through intermediate quotes. The most frequent gaps in the forex market are due to the publication of key economic indicators and more usually to weekend events. However, gaps are relatively rare in forex when compared to other financial markets where they can occur daily. This is mainly due to the large volume and continuous schedule of the forex market (see What is Forex?).

In the previous image, we can see how the price goes from 1.2921 (closing of the candlestick corresponding to 12/07/2012) to 1.2887 (opening of the next candlestick corresponding to 12/10/2012) without the price having crossed the intermediate quotes. In other words, there have been no buy or sell transactions at intermediate prices, therefore there has been a gap in the market.

There is a certain tendency in the markets for gaps to be completed, that is, for the price to move so that the gap is “filled” in a few days. This does not always happen and depends a lot on the force that caused the gap.

Types of gaps

Common gap

A common gap is one that appears in an area without relevance and its size is not important to assess it. This type of gap normally occurs when the price of an asset moves in a price range or is in a consolidation period and is usually small in terms of the price movement of the gap.

Common gaps can occur as a result of events that commonly occur, such as periods where there is low trading volume, and in which a sudden income of liquidity (due to a massive buy or sell trade) can cause a temporary bullish or bearish price jump.

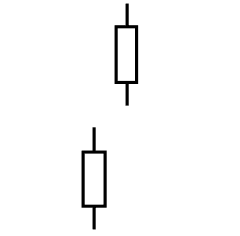

In the following example, we can see a price chart where many gaps are produced but in reality, they are not providing us with information.

Continuation gap

The continuation gap occurs during the development of a defined trend. The gap is produced in favor of the current trend and causes a significant price movement.. This gap type shows us that the trend is strong and will continue.

This type of gap gives us signs of strength in bull markets and weakness in bear markets. Continuation gaps give us signs of strength in bull markets and weakness in bear markets. When they occur within a defined trend, they usually act as support in uptrends and as resistance in downtrends.

If for example we practice daytrading on a 15 to 60 minute chart or swing trading with daily charts, these gaps are good points to place stop loss. In fact, the market considers them as strong support and resistance where traders tend to take and liquidate positions.

Breakout gap

The breakout gap is the most important and clear of all. It occurs when the price opens with a gap of significant size and breaks all possible trends, supports and resistance lines.

In order for this gap to be more reliable, it is important that it be formed together with a strong trading volume because this shows that the market as a whole is strongly supporting a bullish or bearish price movement.

This type of gap usually starts big trends as long as it is not closed for the price in subsequent sessions. If the gap remains open, there is a high probability that the trend in the breakout direction will continue, but if the gap is closed it will indicate that the market has been wrong and strong price corrections may come.

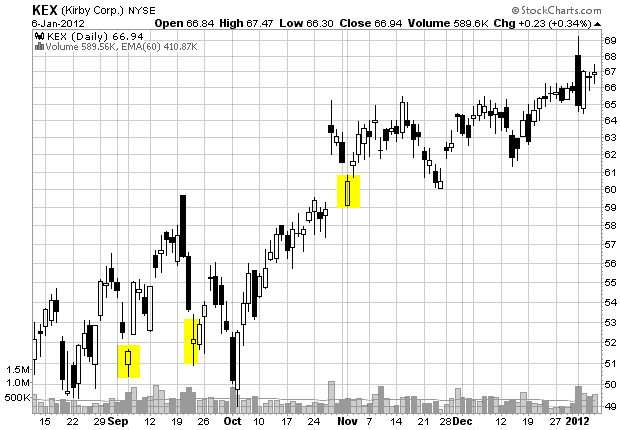

In the following example, there is a breakout gap that starts a large rise, in this case, the next day another gap is produced that makes the upward movement even more reliable.

Exhaustion gap

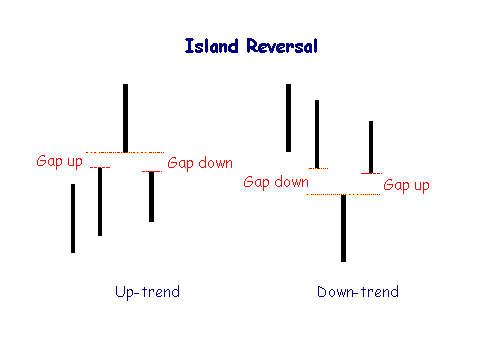

The exhaustion gaps are usually found in the final stages of a trend. To know if it is an exhaustion gap or a breakout gap, it is necessary to wait for its resolution or analyze the area where it has occurred. Normally these gaps are filled in later, often forming the trend change patterns that we have seen previously called Island Reversal chart patterns.

In the following price chart, we see how a breakout gap occurs, which can later be considered an exhaustion gap when the price fills it. When the gap is filled, a considerable decline in the market begins. In this case, a double strategy could have been carried out, first opening bullish positions with the first breakout gap and closing the positions once the bearish trend begins, and then we could have opened bearish positions once the gap has been filled.