What is the Lowry System?

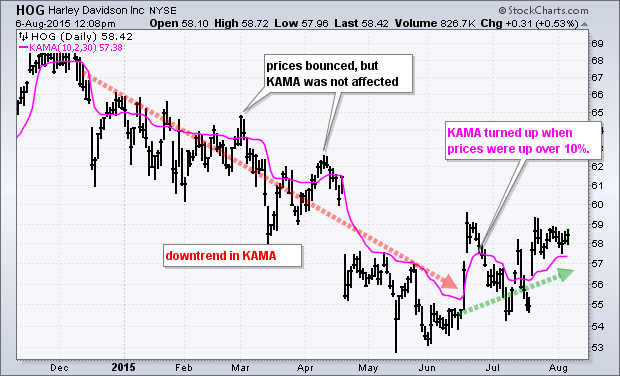

- Delphic Phenomenon (DF): This phenomenon occurs when the moving average of 18 periods and the moving average of 40 periods cross each other upwards (or downwards) and the price has gone below (or above) the moving average of 18 periods. When this happens the buy signal is triggered once the price reaches and exceed the moving average of 18 periods. The sell signal is triggered when the opposite occurs.

- Danger Zone: This is the area between the moving average of 18 periods and the moving average of 40 periods. In this zone is not convenient to open positions in the market because is where the direction of the trend is decided. For this reason it is advisable to wait until a bullish or bearish breakout occurs to open a position.

- System Failure (SF):This occurs when the market makes a Delphic Phenomenom and instead of going up (or down) above (or below) the moving average of 18, it goes in the opposite direction and crosses the moving average of 18 periods. When this happens, the market tends to make a strong move in the direction of the Delphic Phenomenon failure.

Unlike other trading systems based on moving averages crossovers, the moving averages crosses in the Lowry system does not indicate the precise time to open a position in the market. When the crossing occurs that only means that the average value of the last 18 periods is equal to the average value of the last 40 periods for the instrument. This does not necessarily mean that a turnaround in the market trend will occur automatically. To ensure that a change in the market trend has occurred, we must wait until the moving average of 18 periods cross (up or down) the moving average of 40 periods. Also the price of the instrument must cross the moving average of 18 periods in the direction of the two moving averages crossing.

This is the point where we can find the main flaw in many trading systems based on moving average crosses which use these events as trading signals to enter the market as the price tends to make corrections with respect to the rises and falls that caused the crosses . The main advantage of the Lowry system is that it expect these corrections and then enters the market in the same direction of the crossing only if the trend reasserts itself, in other words when the price breaks upward or downward the moving average of 18 periods.

Description of the Lowry System

Instruments

Indicators

- 1 candlestick chart. This trading technique can be applied with any timeframe, but the author recommended its use to trade in 1 day charts.

- 1 Exponential moving average of 40 periods.

- 1 Exponential moving average of 18 periods.

- 1 Exponential moving average of 4 periods to follow the immediate trend of the market.

Trading System Rules

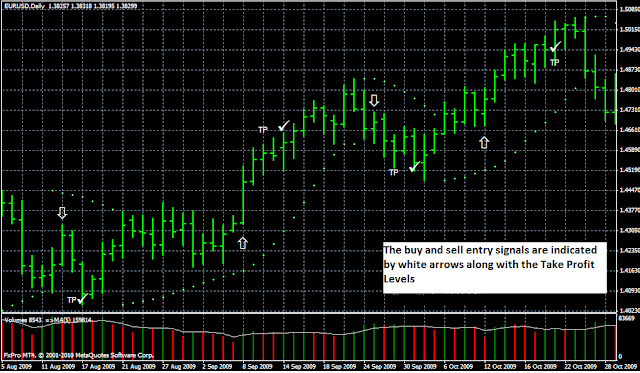

- Buy Signal: If the 18-period moving average crosses the 40 period moving average in an upward movement and the 4-period moving average also crosses the moving average of 18 periods in the same direction, we open a buy position. This can be done by entering the market directly through a market order after the crossing or by placing an entry order above the moving average of 18 periods.

- Sell Signal: If the 18-period moving average crosses the 40 period moving average in an downward movement and the 4-period moving average also crosses the moving average of 18 periods in the same direction, we open a sell position. This can be done by entering the market directly through a market order after the crossing or by placing an entry order below the moving average of 18 periods.

- Stop Loss: The stop loss can be placed above (short position) or below (long position) of the moving average of 40 periods. If the market moves in our favor, we can change the stop loss and position it so that it follows the movement of the 40-period moving average. In this way, we can take advantage of a trend in all its extension until it is exhausted.

- Take Profit: If the market moves in our favor, we can maintain the position opened until the moving averages of 18 and 40 periods cross each other in the opposite direction (a strong signal of a market trend change). In order to protect the profits, we can move the stop loss along with the 40-period moving average, in order to preserve our earnings in a sudden market movement.

Additional Notes About the Strategy

- As we mentioned at the beginning, this is a trading technique for trending markets. In the case of markets that are moving in a range (low volatility markets), this strategy will produce multiple false signals, so it could be useful to combine with a strength trend indicator such as the ADX. Other technical indicators that can be used as a filter are the MACD and the W%R. The combination of this strategy with these indicators will allow us to enter the market with greater security.

- Unlike other moving averages crossover trading systems, the crossing of the moving averages of 18 and 40 periods does not indicate the time of entering the market. The trader must be patient and wait for the right time to open a position according to the rules described above.

- If a System Failure occur and the price of the instrument breaks the moving average of 40 periods, the trader could take this as a trading signal to enter the market in the direction of that breakout movement.

A variation of this technique can be studied through the following link: