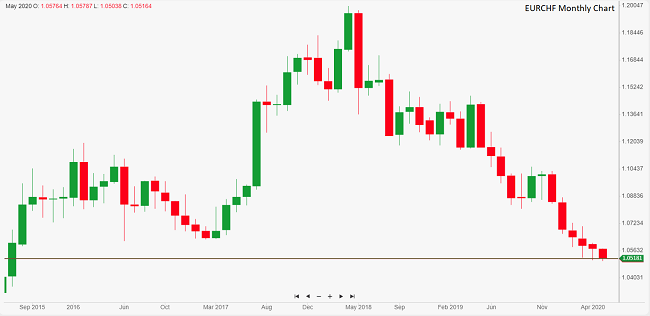

Risk aversion remains the predominant sentiment in the markets, supporting safe havens and affecting risk-related assets. This dynamic is well illustrated by the performance of the euro against the Swiss franc. Following President Trump’s statements yesterday, threatening to withdraw from phase one of the trade agreement with China, the franc reached 1.05038 against the single currency, the highest value in 5 years.

The apprehension around a possible second wave of the coronavirus was already calming the spirits of investors, who, however, had found reasons to be optimistic in partially lifting the blockade in Europe and America; these fears are now compounded by Donald Trump’s latest aggressive tirade toward China, with the markets stating that, in the face of the worst economic contraction since World War II, the reignition of trade tensions between the United States and China is the last thing the world economy needs.

Gold continues to rise

Gold is on its fourth consecutive positive day and technically we could be close to a further breakout higher. The bullion spot price is playing with the resistance mentioned in previous reports at $1,730/1,735 and is trying to break this level. From a technical point of view, a close of the week above this threshold would be confirmation of the bullish environment and we could see more buyers entering the markets above, while we would only have a weak signal only below $1,680. We are now on the upside of the side channel seen in the past few weeks and buyers are still very active with gold, and continue to push prices close to the 7-year high for bullion.

European shares with volatile behavior

European markets showed volatility as they rose further on Friday when traders weighed in on China’s mixed data overnight. Investors were pleased to see China’s industrial production estimates for April, but were disappointed by the drop in retail sales, which revealed weak demand in almost all sectors, and remains the biggest bearish leverage for stocks at this time. The deepening of tensions between the United States and China, as President Trump ruled out any impending conversation with Xi Jinping, added to the current environmental uncertainty before the weekend.

However, on a more positive note, there are signs of stability in the oil markets following Saudi Aramco’s decision to cut sales to its key buyers and rumors of tighter supply from other counterparties. The IEA’s view that oil markets were showing “signs of improvement” has fueled market sentiment towards energy stocks, making it one of the highest performing sectors in Europe this morning. Despite today’s bullish open, traders are likely to remain cautious ahead of a new batch of significant US economic data

The DAX-30 index has recovered this morning with prices now trading near the 10,500 level after another solid rebound of more than 10,200 pts. However, the market will have to clear the 10,560 level to invalidate its very short-term downtrend and return to its previous highs at 10,770 and 10,980 per extension.