What is Forex Dominion?

Do you want to have the best information about the Forex market and trading? Then you are in the right place.

At present, millions of people around the world invest in financial markets and this amount is growing day by day thanks to the many opportunities offered by these markets

Forex, stocks, indexes, commodities, ETFs, and other markets are the places where large and small traders earn and lose large fortunes on a daily basis.

However, trading is not easy. Trading in markets like Forex requires a lot of knowledge, experience, and proper psychology.

In Forexdominion we include abundant educational material about the market, including tutorials about the Forex market, technical analysis, fundamental analysis, trading psychology, and trading strategies.

In the world, there are hundreds of stock, futures, Forex, and CFD brokers. Here we show the best brokers in the Forex and CFD sectors, grouped into lists where we classify them according to their main characteristics. For example, we show the best ECN, STP, Market Makers, and DMA Forex brokers.

Recommended brokers

| Best Broker From Australia

| Recommended ECN Broker

|

|---|---|

Best Multi-asset Broker

| Recommended ECN/STP Broker for Beginners

|

Recent articles of Forex Dominion

- What types of crypto tokens exist?Do you know what tokens are in cryptocurrencies and how you can use them? Tokens are objects that represent something, whether abstract or physical. In the world of cryptocurrency, tokens can have value and are … Read more

- What is double spending in cryptocurrencies?Double spending in digital transactions consists of the possibility of spending the same digital currency more than once. This occurs due to counterfeiting or duplicating digital files representing the currency. Risks include the creation of … Read more

- Stochastic RSI Screener For Metatrader 4Modified indicator for Metatrader 4 that displays bullish and bearish signals from the Stochastic RSI oscillator, which, as its name suggests, is based on the well-known Relative Strength Index (RSI). This indicator, called RSIEst Screener, … Read more

- Investing in Stocks with BlackBull SharesThe online Forex and CFD broker Blackbull Markets offers a trading service for spot stocks called BlackBull Shares. This service allows you to buy and sell over 26,000 securities from various markets. In this article, … Read more

- What are NFTs (Non Fundigle Tokens) and how do they work?In this article we’re going to explain to you what NFTs (Non Fungible Tokens) are and how they work, so you can understand one of the technological innovations aimed at art emerging from the blockchain, … Read more

- Trading System with the Awesome, Stochastic, and EMA indicatorsNext, we will present a simple technical analysis trading system based on signals from three well-known technical indicators: the stochastic oscillator, the Awesome oscillator, and the exponential moving average (EMA). As such, it is a … Read more

- What is slippage in stocks day trading?In an ideal world, when a daytrader place an order, the trade is executed at exactly the price specified. However, under certain conditions, the trade or operation can be executed at a different price. For … Read more

- Woodie’s Pivot Points – Definition and FormulasPivot points are a valuable tool for traders as they allow the calculation of support and resistance levels that can be used as a reference point to develop an entire methodology or approach to trading … Read more

Forex Education

Forex Guide

- What is slippage in stocks day trading?

In an ideal world, when a daytrader place an order, the trade is executed at exactly the price specified. However, under certain conditions, the trade or operation can be executed at a different price. For example, if an intraday trader places a stop loss after having taken a long position … Read more

In an ideal world, when a daytrader place an order, the trade is executed at exactly the price specified. However, under certain conditions, the trade or operation can be executed at a different price. For example, if an intraday trader places a stop loss after having taken a long position … Read more - The role of fear in investment

Sure we’ve all read a book or article on sectors, markets or companies with potential, deep fundamental analysis, or interesting investment systems. But investors and traders less often discuss a subjet that ultimately has as much or more influence on investment: psychology in general and in particular the fear that an investor … Read more

Sure we’ve all read a book or article on sectors, markets or companies with potential, deep fundamental analysis, or interesting investment systems. But investors and traders less often discuss a subjet that ultimately has as much or more influence on investment: psychology in general and in particular the fear that an investor … Read more - What are meme stocks?

Meme stocks are the result of applying popular culture to financial markets. The list of companies turned into meme stocks on U.S. exchanges has been expanding in recent months, affecting a broad group of companies. But what exactly are meme stocks? Meme stocks are publicly traded companies whose stock prices … Read more

Meme stocks are the result of applying popular culture to financial markets. The list of companies turned into meme stocks on U.S. exchanges has been expanding in recent months, affecting a broad group of companies. But what exactly are meme stocks? Meme stocks are publicly traded companies whose stock prices … Read more - Quadruple witching – Definition and Market Impact

The term “Quadruple Witching” refers to a specific date on which four different types of financial derivatives contracts expire simultaneously. These contracts include stock index futures, stock index options, single-stock futures, and single-stock options. This event occurs four times a year, on the third Friday of March, June, September, and … Read more

The term “Quadruple Witching” refers to a specific date on which four different types of financial derivatives contracts expire simultaneously. These contracts include stock index futures, stock index options, single-stock futures, and single-stock options. This event occurs four times a year, on the third Friday of March, June, September, and … Read more - What are pending orders?

Pending orders are instructions given by traders to their brokers or trading platforms to buy or sell an asset at a specific price in the future. These orders are also known as limit orders or stop orders and allow traders to set up trades ahead of time, even when they … Read more

Pending orders are instructions given by traders to their brokers or trading platforms to buy or sell an asset at a specific price in the future. These orders are also known as limit orders or stop orders and allow traders to set up trades ahead of time, even when they … Read more - Oscillator of a Moving Average (OsMA) – Main Features

The OsMA (Moving Average of Oscillator) is a technical analysis indicator that measures the difference between an oscillator (usually the MACD) and its signal line (usually a moving average of the MACD). The traditional OsMA is usually derived from the MACD (Moving Average Convergence Divergence) indicator, which is itself a … Read more

The OsMA (Moving Average of Oscillator) is a technical analysis indicator that measures the difference between an oscillator (usually the MACD) and its signal line (usually a moving average of the MACD). The traditional OsMA is usually derived from the MACD (Moving Average Convergence Divergence) indicator, which is itself a … Read more

Technical Analysis

- Woodie’s Pivot Points – Definition and Formulas

Pivot points are a valuable tool for traders as they allow the calculation of support and resistance levels that can be used as a reference point to develop an entire methodology or approach to trading in the market. Another popular method for calculating pivot points is Woodie’s Pivot Points, which … Read more

Pivot points are a valuable tool for traders as they allow the calculation of support and resistance levels that can be used as a reference point to develop an entire methodology or approach to trading in the market. Another popular method for calculating pivot points is Woodie’s Pivot Points, which … Read more - Long White Candlestick Pattern

The Long White Candle candlestick pattern appears opening near the minimum and closing very near the maximum of the market session. Its figure is much larger than those produced by the normal White Candles that are formed in price charts. Therefore to differentiate the two candles the trader should analyze … Read more

The Long White Candle candlestick pattern appears opening near the minimum and closing very near the maximum of the market session. Its figure is much larger than those produced by the normal White Candles that are formed in price charts. Therefore to differentiate the two candles the trader should analyze … Read more - Oscillator of a Moving Average (OsMA) – Main Features

The OsMA (Moving Average of Oscillator) is a technical analysis indicator that measures the difference between an oscillator (usually the MACD) and its signal line (usually a moving average of the MACD). The traditional OsMA is usually derived from the MACD (Moving Average Convergence Divergence) indicator, which is itself a … Read more

The OsMA (Moving Average of Oscillator) is a technical analysis indicator that measures the difference between an oscillator (usually the MACD) and its signal line (usually a moving average of the MACD). The traditional OsMA is usually derived from the MACD (Moving Average Convergence Divergence) indicator, which is itself a … Read more - Klinger oscillator in trading: how to take advantage of this indicator?

The Klinger oscillator in trading is one of many technical indicators used to find buying and selling opportunities in financial markets. The Klinger oscillator is unique in that it takes into account both price and volume data in its calculation. The theory behind the indicator is that strong price movements … Read more

The Klinger oscillator in trading is one of many technical indicators used to find buying and selling opportunities in financial markets. The Klinger oscillator is unique in that it takes into account both price and volume data in its calculation. The theory behind the indicator is that strong price movements … Read more - Bull Power and Bear Power Indicators

The purpose of this article is to provide traders with a detailed explanation of the use of Bears Power and Bulls Power indicators, their calculation and their signals with a step-by-step tutorial. We will also explain how to use these indicators for trading in the financial markets. Bulls Power – … Read more

The purpose of this article is to provide traders with a detailed explanation of the use of Bears Power and Bulls Power indicators, their calculation and their signals with a step-by-step tutorial. We will also explain how to use these indicators for trading in the financial markets. Bulls Power – … Read more - Money Flow Index Indicator | Overbought and oversold zones

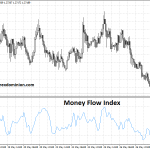

The Money Flow Index Indicator, or MFI indicator, is a technical indicator used to identify overbought and oversold zones. To understand the importance of this indicator, it is necessary to ask the following question: what moves the markets? The shortest answer maybe supply and demand. If the demand for an … Read more

The Money Flow Index Indicator, or MFI indicator, is a technical indicator used to identify overbought and oversold zones. To understand the importance of this indicator, it is necessary to ask the following question: what moves the markets? The shortest answer maybe supply and demand. If the demand for an … Read more