What is a Gap and Trap?

A “Gap and Trap” is a price formation that can be observed in a individual stock, a market index, a currency pair, futures contract or other instrument or asset traded in financial markets.

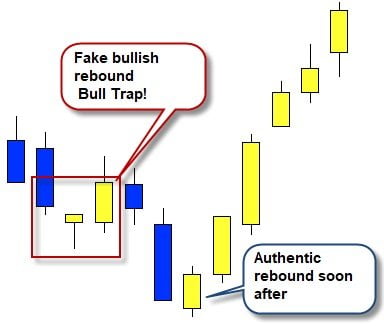

The “Gap and Trap” occurs when there is an upward gap between one trading session and another, and investors begin to buy in the first minutes of the new session, when the price suddenly changes direction and begins to fall, trapping traders who bought shortly after the opening. Hence comes the name of the event, as “Gap” is the space between the closing price of the previous session and the opening price of the current session and “Trap” is referring to traders (buyers) who get caught in the market.

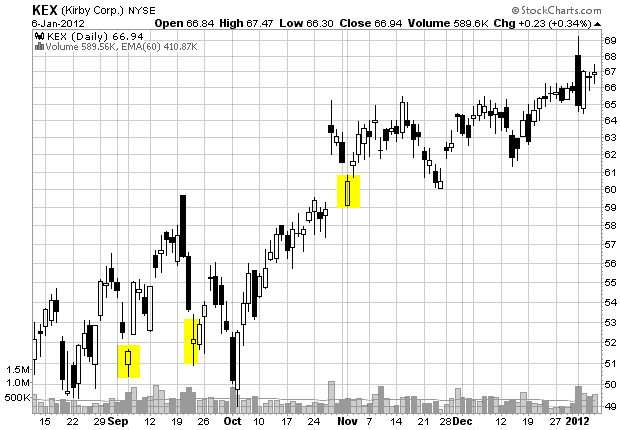

Example of a Gap and Trap

To better understand the Gap and Trap we can analyze the following example:

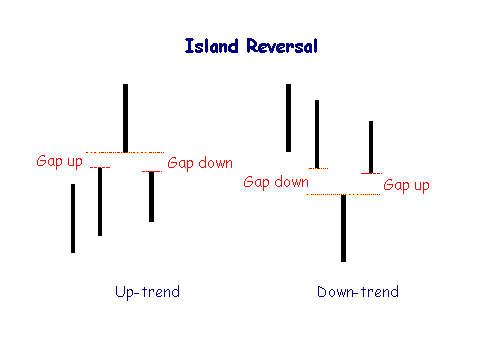

A company with the symbol ABC showed positive results according to the expert analysis during the weekend. The stock, which closed at $10 last Friday, opened on Monday morning with a bullish gap to $ 11.50. A bullish gap (gap up) is when the price of the instrument opens at a higher price with respect to the closing price of the previous session, while a bearish gap (gap down) is when the market opens at a lower pric compared to the previous session.

Given this rise in price, and because of the positive analysis that the company received during the weekend, many traders and investors buy the stock ABC on Monday morning during the first minutes after the market opening. Some even place orders on Sunday due to the good news abou the company, so they can be among the first to enter the market during the supposed rise of the stock. At the time of opening, all these trades increase the purchase price so the stock rises to $11.80.

However, soon the price of ABC reverses direction, and at the end of the day closed at $10.30. The investors who bought during the opening were “trapped” after the price reached $11.80 (session high) and began to fall hard, and now they accumulated heavy losses in their positions. This is a classic example of a “Gap and Trap.”

Gaps and Traps in Forex

Gaps occur in all markets, but in the case of Forex, the phenomenon is observed less frequently as this market operates Monday to Friday 24 hours a day continuously (the operations stop at weekends). However, sometimes major bullish or bearish gaps between the closing price on Friday and Monday opening price are observed, so always take into account this possibility. It is important to be careful and avoid falling into impatience. It is also essential to carefully study the market in which we invest. The market makers often try to raise the price of an asset or instrument in order to catch the inexperienced and anxious investors who want enter the market too quickly.