What are the Ladder options?

Ladder binary options are a peculiar sort of binary option contract, which isn’t even widely available: only a limited number of brokers feature them. Still, some traders prefer the ladder, because it’s a little more intricate and a little more interesting for many than a simple Put/Call or Touch/No Touch contract, plus, it allows traders to take advantage of more sustained bullish or bearish trends, while mitigating some of the risks that come with such an approach.

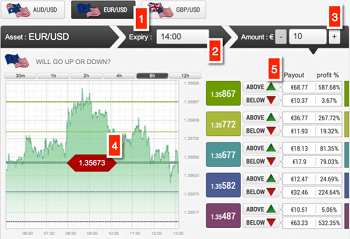

The best way to define a ladder trade is that it’s essentially several trades in one. Several price targets are used in these trades, which are arranged like the steps of a ladder (hence the name), Each of these steps is essentially a Touch trade, as the trader is looking for the price to hit as many of his targets as possible. The payout for the trade is also split into several parts, in predetermined percentages for each of the price-targets that make up the ladder. If a trader hits his first target, he’s essentially guaranteed some payout, therefore, even if the other price targets are missed, he will still not be left empty-handed. It is all too possible for the trader to miss all his targets though, in which case, his entire investment is lost.

Read more