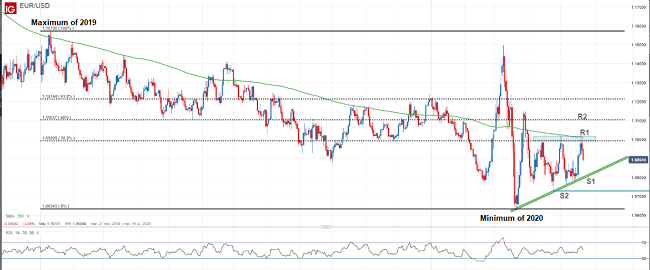

- The EUR/USD is recovering after testing the 1.1200 level, but the bullish outlook is still unclear.

- The disappointing data from the United States caused the dollar bulls to be in suspense for the time being.

The EUR/USD has been moving around 1.1200 since the beginning of the day, bouncing from the area in a modest way, since the psychological barrier is a level difficult to break. However, the US currency maintains its strength, since the latest macroeconomic publications in the United States make investors doubt a turn in the monetary policy of the Federal Reserve, given that consumption continues to be resilient. The central bank of the United States is scheduled to meet this week, and its decision will be key to the dollar. Meanwhile, Benoit Coeure of the ECB warned of “gloomy” indicators on the health of the global economy, and that the risks could materialize in the next meetings.