In this article, we are going to explain the most common traps in the markets, known as bull trap and bear trap, how we can avoid them and, above all, how we can take advantage of these market conditions. Pay attention, because this article is going to take you from the losers side and put you on the side of the smart traders.

The traps can be bullish or bearish. The traps for buyers are called bull traps and the traps for sellers are called bear traps. Generically, we sometimes refer to a trap as a swing trap.

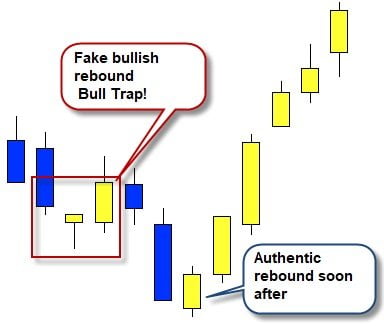

First of all, we will look at how a market trap is formed. After all, it is simply a thing that is not what it seems to be. The price goes in one direction and we, as rebound hunters, wait for the right moment to open a new position in the opposite direction. However, it is a trap! Now that we are inside, the price continues with its previous movement, destroying our idea of making money.

Read more