The year 2018 has been marked by tensions and uncertainty. The commercial war between the United States and China has been carried to its maximum level, the rise of interest rates and QT (quantitative tapering) has continued in the US and in Europe the QE (quantitative easing) has been ended. Towards the end of the year the atmosphere is even more tense with the “gilets jaunes” (yellow vests) in France, the political escalation between the US and China and the fall of the world stock markets. On the other hand, the price of oil is practically at a minimum, although it seems to start to rise, which has helped to reduce the increase in global political-economic tensions.

On the one hand, the low price of oil contains inflation, which reduces the pressure towards the contraction of the monetary stimuli of the main world banks and on the other hand supposes an injection of disposable income for consumers.

The US has been raising interest rates since 2015, currently the interest rate is at 2.5%, while in Europe the ECB maintains its constant interest rate of -0.4% for deposits and 0.25% for credit facilities. Inflation in the US is close to 2.177% while in Europe it is approximately 1.955%. On the other hand, the differential of the performance of the German debt against the American debt has been increasing since 2011 and has been followed by the depreciation of the euro. To this we must add the increasing disparity between the yield of the bonds at European level, which was “solved” through the OMT (Outright Monetary Transaction) and later the QE but now threatens to refloat. During this year the euro has depreciated against the dollar close to 6%.

The situation in Italy and more recently in France has increased tensions in Europe, raising doubts about the European fiscal pact (3% deficit and 60% debt). This added to the eventual difficulty of financing of some countries of the euro zone with the end of the QE (it is necessary to take into account the amount of public debt that is bought directly or indirectly by the ECB) sows some doubts about the maintenance of the same . The case of Italy is perhaps the most alarming, but remember that Spain continues with close to 100% of debt over GDP and the deficit is slightly below 3%.

To the fiscal tensions we must add the increasing demands on the part of the citizens, a paradigmatic example are the “gilets jaunes” (yellow vests) in France and the tremendous difficulty the government will have to balance budgets that please everyone within the EU .

Regarding the future evolution of the EUR/USD will have to take into account that the QT and the rate hike in the US will continue while in Europe will continue to reinvest the maturity of the bonds and the rate hike is not expected until at least next year. The outcome of the Italian and English problems, among others, will also be decisive.

The Brexit, whose implementation without agreement, although unlikely, could have serious economic consequences. In the case in which there is no consensus in the House of Commons, whose vote May postponed because the risk of not reaching an agreement, several possible outcomes will be opened. A modification of the agreement and Brexit agreed, a motion of censure, early elections, another referendum or a Brexit without immediate agreement. Recall that the date set for the exit is March 29, 2019. During this year the pound has depreciated about 2.3% of the euro.

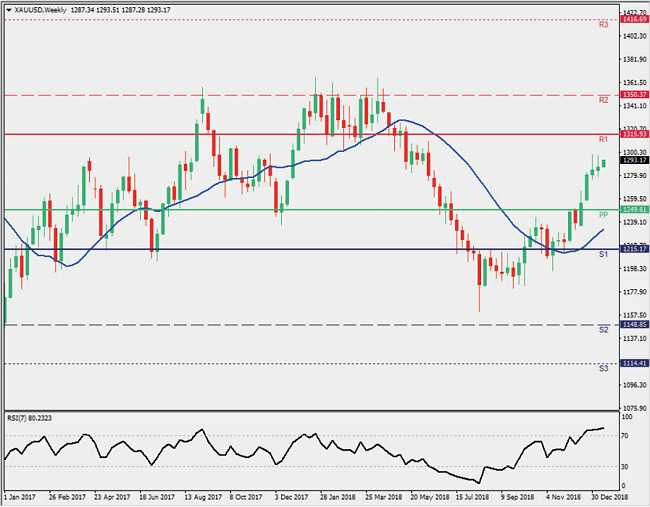

The yen has remained relatively stable against the dollar during the year despite being the most backward (ECB, FED, BOJ) of the three in terms of normalization of monetary policy. Inflation in the Japanese country remains below 1%. Gold and Bitcoin seem to start to resurface after the collapse of the stock markets, but both are below the level of the beginning of the year. In the case of Bitcoin, the price at the end of the year is 4 times the price at the beginning of the year.

| Currency pair | Beginning of the year | End of Year |

| EURUSD | 1.22 | 1.139 |

| GBPUSD | 1.334 | 1.264 |

| USDCHF | 0.959 | 0.991 |

| USDJPY | 111.097 | 110.80 |

| USDCAD | 1.241 | 1.360 |

| AUDUSD | 0.79827 | 0.704 |

| EURGBP | 0.88 | 0.901 |

| BTCEUR | 14273 | 3315 |

| GOLD | 1317.310 | 1271,8 |

In short, traders should be vigilant this year to see how events unfold. It will be necessary to direct attention to the conclusion of Brexit, to the advance of populisms and their threat to European stability, as well as to the economic slowdown and its effects on political tensions.