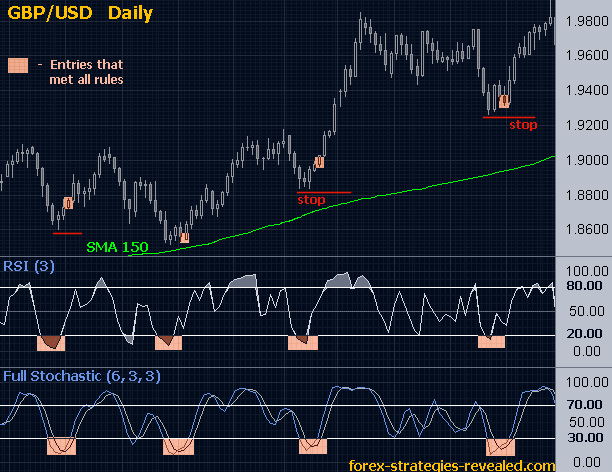

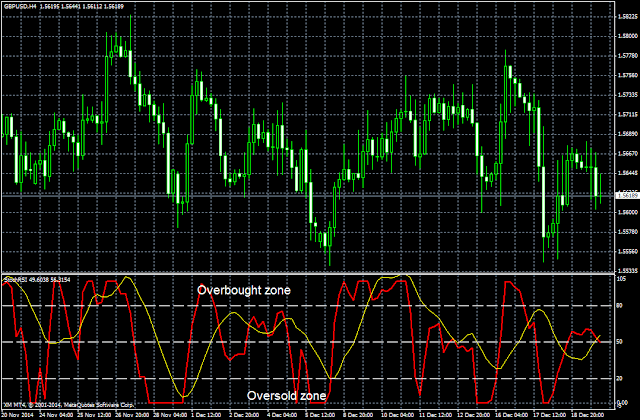

As we can see, unlike other indicators, the RSI Stochastic was able to reach the overbought/oversold levels on more occasions and even remained in these levels longer before moving in the opposite direction.

Now let’s look more closely at the overbought and oversold conditions created by the RSI Stochastic:

Rules to trade with the Stochastic RSI

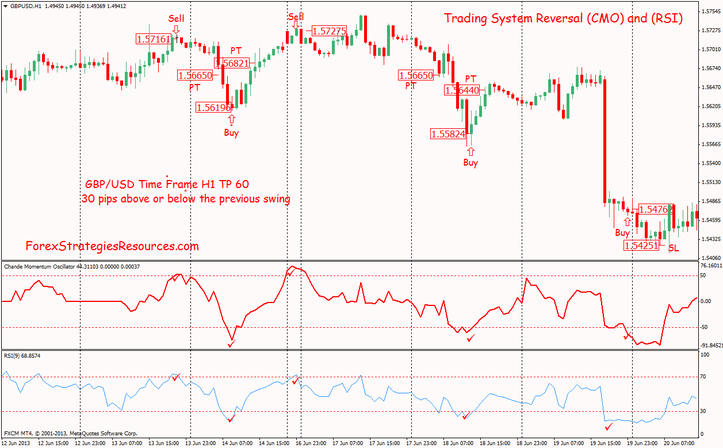

- Wait for the stochastic RSI reaches overbought and oversold levels:

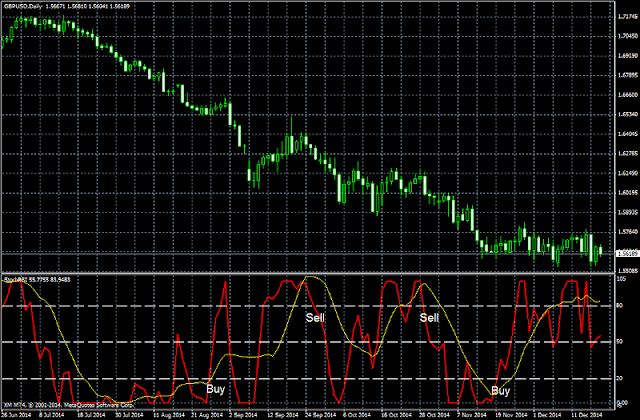

- When the RSI leaves the oversold zone (below 20), we can open a buy position.

- When the RSI leaves the overbought zone (above 80), we can open a short position.

We note that unlike the RSI, where we use the levels 30 and 70 to indicate oversold/overbought conditions, in this indicator the levels used are 20 and 80, the same as in the case of the stochastic oscillator.

Another point to consider is that the reaction to signals from the indicator should occur only after the d% line (the thin yellow line) has also reached the overbought/oversold levels. If this line has not entered the overbought/oversold zone, any buy/sell signal from the Stochastic RSI produced when it crosses the level 80 downwards or the level 20 upwards, should be ignored, at least temporarily.

- Above 50, the trend is up.

- Below 50, the trend is down.

Stochastic RSI formula

The formula to calculate this indicator is the following:

Stochastic RSI = (RSI – Lowest Low RSI) / (Highest High RSI – Lowest Low RSI)

The Stochastic RSI measures the value of RSI relative to its maximum and minimum value throughout the period of time required. When the regular RSI reaches a new low during the period, Stochastic RSI is 0. When the regular RSI reaches a new high during the period, the stochastic RSI is 100.